Richard Corbett, Voi’s regional general manager UK, Ireland and Benelux, speaks to Zag about how the Swedish-based company has built up a 60% market share in the UK, when it expects to make a profit and the next steps for future growth.

Zag: Why has Voi won so many contracts with towns and cities in the UK compared with other operators?

Richard Corbett: All I can say is how we have approached the process. Everything we do is based on the fundamental premise of zero tolerance towards accidents. That’s very important to cities.

We also take what we call a hyperlocal approach. There are certain operators that create a very scalable one size fits all approach to micromobility. That’s not what we do.

The service design and how we approach running a mobility service in a city is built from scratch for each market. Each town or city is different, from the public transport infrastructure, to the demographics and topography. All these factors will have an impact on the deployment, speed limits, operating hours and how e-scooters coexist with other forms of transport.

The Swedes also love the UK. Leading the UK market was something every single person in our 500 team at HQ wanted to achieve. That helped to create great tender responses but it’s helped since then to deliver our service. We have built a team of 65 in London and 200 across the UK in the space of nine months.

Zag: All operators will say they are obsessed with safety, so what makes Voi different?

RC: You could argue it’s very much a homogenised market. Everyone is claiming to do the same thing. I think cities are able to differentiate between those who are saying it for the sake of saying it and those who are genuinely walking the walk and following through with investment and results. Providing evidence is super important to any winning bid. You can’t just make the claim you’re obsessed with safety. Tell me why and how? That is fundamentally the difference (see more below).

Zag: Coventry stopped its trial with Voi five days after launch due to pavement riding. What did you learn from that experience that has helped improve the way you launch other services?

RC: We created the ambassador programme (Voi employs teams to help with enforcement and safety on the ground) and our three strike policy after launching in Coventry. The challenge on incidents wasn’t unique to Coventry. All operators will see non-compliance, particularly in the first month of any launch. The point of the trials is to find these challenges.

We agreed with Coventry to suspend the service and adapt our model. We created a 10 point launch plan as a result and that plan is how we launch in every new market in the UK in a more controlled manner. We have relaunched in Coventry at Warwick University and we’ll grow from there. Since Coventry we’ve had 14 launches since with no trials stopped. It has been a valuable lesson and we’ve applied that to other markets.

Voi UK factfile:

UK fleet size: Circa 6,000

Number of registered active UK riders: 140,000

Number of safe rides completed so far: One million

Number of locations: 17 cities and towns – Northampton, Birmingham, Liverpool, Bristol, Bath, Cambridge, Peterborough, Oxford, Kettering, West Bromwich, University of Warwick/Coventry, Corby, Wellingborough, Rushden, Higham Ferrers Portsmouth and Southampton

Zag: How are you dealing with non-compliance from riders and can you share some tangible results from what you have put in place?

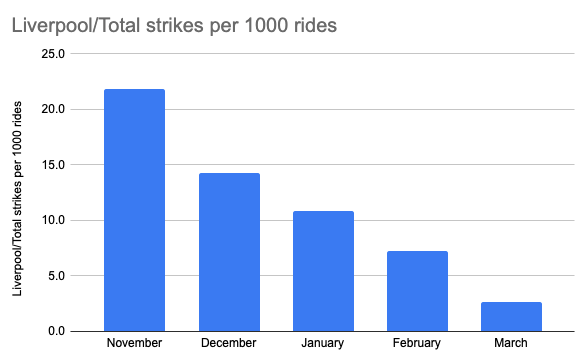

RC: We will have six to 15 ambassadors out in the city who will be helping people with riding and handing out helmets. If they see non-compliance, or if we track non-compliance through our app, that is all reported through the back-end system and we have a three strike policy. Once people know they’re accountable, they act differently. Liverpool has seen an 88% decrease in strikes from November to March. Northampton has seen a 47% decrease in strikes from October to March.

Over 95% of cases only receive one strike. We also incentivise good behaviour, so if you wear a helmet or park in the right location you can get discounts on subsequent rides. The mix of technology and having people on the ground is giving cities the comfort that we’re in control and on top of compliance.

Zag: Is Voi profitable in the UK and what kind of volumes do you need to make this sustainable?

RC: Profitability isn’t our focus for year one. That’s the case for any market, but particularly in the UK because it’s a trial. There’s a huge amount of investment required to launch a new form of mobility in a new market (tens of millions over the course of the UK trial). We would hope from year two onwards we would be looking at profitability.

Voi has the top five cities in terms of volume currently. We’ve been particularly conservative on volumes over the first six months, but we’re going to start ramping up over the next few weeks. We have been focussing on education, infrastructure and awareness. We’ve seen strikes significantly reduce.

Zag: What’s your view on the potential for extensions for the DfT trials and whether towns and cities will re-tender?

RC: We don’t know yet. The latest deadline for all e-scooter trial approvals is March 31, that’s not to say it won’t be extended again and there’s potential for that to happen. The current trials are scheduled to end by October this year and it would be an educated guess to say we might see a six month extension, particularly if the London trial hasn’t started yet.

Zag: Do other operators want an extension of the e-scooter trials?

RC: There is a huge push from some operators not to extend the deadline. Most operators have won one or two markets and so they would like to re-tender for a chance to win more. There has also been push back from the Department for Transport (DfT) to say they need more time to conduct a decent trial in each city. London carries a heck of a lot of weight.

Zag: Why have nearly all locations only gone with one operator and should the market be more open for multiple operators?

RC: It’s for the cities to decide. From our perspective we would hope where we have relationships that they would continue, but it’s an open marketplace. If a location lets us know they would like to add an additional operator to a location, we would of course work with them. I do think depending on the size of the city, there is an argument to be made for having one operator. There’s also a deeper level of engagement with a city and sharing of data. Are cities duplicating the amount of work by working with multiple operators? Is the city getting more for the public? These are all questions they need to ask. In a city like London, you can argue it makes sense to have multiple operators because the area is so big. There are pros and cons to both.

Zag: What’s the biggest challenge you face from starting to turn up the dial on volume in the markets you’re already in?

RC: We won’t scale unless we see incidents are as close to zero as possible. That’s a two way relationship with the local authority. Once they’re comfortable at the current scale and they feel the service is manageable, then we can go to the next level. Over the last three to six months we’re now seeing a bedding-in period where e-scooters are more accepted as a mode of transport. When we start ramping up volume, it’s important we continue to monitor where we are on compliance and incidents. I don’t see any great challenges to scaling. What we’ve seen in the UK so far is a huge demand for e-scooters. We’re about to approach one million safe rides. We’ve seen in the winter months the utilisation rates at the levels we were expecting in the summer.

We’re still trying to understand if that’s due to transport distancing (people concerned about travelling on public transport due to Covid-19). As long as we adopt a stage and gate process where we scale and review, that’s the best approach.

Zag: Why do you think e-scooters are attracting such negative press from mainstream media. Why have they seemed to get this “public nuisance” badge from some?

RC: When there’s a change in any industry you will see a clash between those that like how things were done in the past and those who are embracing the new. Where we will start to climb out of the situation and see e-scooters as more socially accepted is when legislation comes into play. There is a perceived grey area by the public on using private e-scooters and there are retailers who are selling them knowing full well riders will be using them in public spaces.

There aren’t any guidelines for private e-scooter use, the police are also under-resourced to enforce the rules. Better infrastructure will help too. Our cities have been designed and planned around the car. No one looks out of their window thinking about how cars have cluttered our roads. It’s just considered life. If you see five scooters on the pavement it’s called clutter. There’s a mind-set and infrastructure change that needs to happen. We need to change how we think about how space is allocated. I’d love to see cities and towns start turning some parking spaces into micromobility spaces. Whether that’s through parking racks or space the council will allocate and take away from cars.

Zag: Is private e-scooter legalisation inevitable and what part do these UK trials have in influencing future legislation?

RC: I think private e-scooters will be legalised, although the timeframe on that is unclear, but most likely not until 2022. Private e-scooters have to be regulated in a way that is consistent and aligned with shared public e-scooters. There is a level of accountability that operators like Voi bring to the table through GPS tracking and knowing exactly where and who is riding a scooter at any one time. Unique identifiers or number plates, like are used on Voi products, is something I would advocate. This level of accountability will drastically improve compliance and reduce anti-social behaviour that we see more so with private e-scooters compared with public e-scooters.

Avon and Somerset Police released data in December 2020 to show out of 96 incidents involving e-scooters, two were related to Voi and 94 related to private e-scooters. We are seeing an unfortunate growing trend from the private e-scooter market for anti-social behaviour that needs to be addressed. I’d like to see an alignment of standards with GPS trackers and geofencing so no ride zones apply to all micromobility, regardless of whether it’s private or shared.